Improving Your Company Benefits Package Without Increasing Cost: Part 4

For many U.S. employers, offering health insurance as a company benefit is now a legal requirement. However, for those companies smaller than 50 full-time-equivalent employees, the decision to offer benefits – and generous, high quality benefits at that – can be one of the best business decisions you ever make. However, the cost can be prohibitive. This series takes a look at ways to continue to improve your benefits package without substantially increasing your costs – and in some cases, decreasing your costs.

Method #4: Offer 3 Tiers of Plan Choices

Small group health insurance plans under the Affordable Care Act come in 4 metal tiers: Bronze, Silver, Gold, and Platinum. Between the carriers, the different tiers are designed to have similar levels of benefits – for example, a Health Net Gold PPO should be similar to an Anthem Gold PPO. Obviously the higher the metal tier the higher the benefit… and the higher the cost. Many employers start offering benefits when their group is small, and offer just one plan option, but then never change that. I always strongly encourage offering 3 plan tier options, no matter what size your company is. It will not cost you anything extra – and in fact, it might save you money.

The trick to managing this method is in the way you contribute to the premiums for your employees:

1. Contribute a percentage of the premium based on your mid-level plan. If you are offering Silver, Gold & Platinum, then pay your chosen percentage (50%, 70%, 100% – whatever it may be) based on the Gold premium.

2. Because it is a “base plan” contribution level, the dollar amount you are paying stays the same, whether the employee chooses Silver, Gold, or Platinum. That dollar amount is individualized per employee because under ACA, each age year is a different cost on a small group plan. So your percentage on the Gold is a different dollar amount for each employee.

3. Employees who wish to save money will “downgrade” to the Silver. If the Silver premium is less than the Gold dollar amount you are paying, you will actually only pay up to the total employee premium, so you save money.

4. Employees who want better coverage will “upgrade” to the Platinum. The difference is taken out in their payroll deductions, so the additional cost is their responsibility.

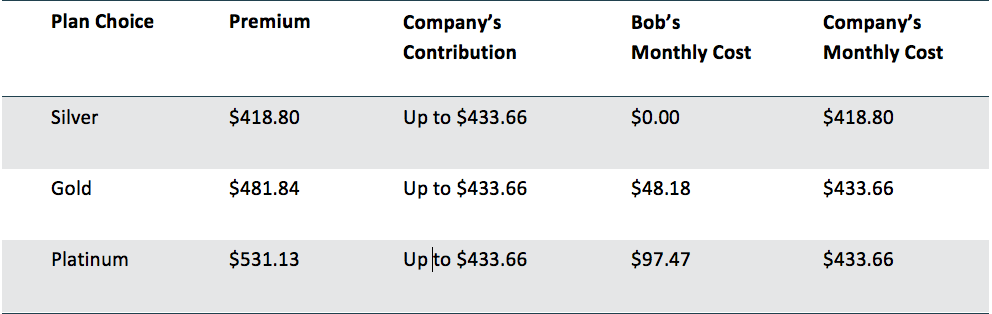

Below is an example of what this looks like. We are pulling real Kaiser rates for an example company below. This company offers the Kaiser Silver, Gold & Platinum and pays 90% of the employee premium at the Gold level.

Our example employee is “Bob”. Bob is 45, so his full Gold premium would be $481.84. Because the company pays 90%, they pay $433.66 per month. You can see below that Bob can choose his plan based on the benefit level and monthly cost.

When you use three tier levels of coverage and a base plan contribution, the employee is happy because they have choices in their cost and coverage. If better coverage is a priority, they can upgrade. If they are on a tight budget, they can downgrade. And as an employer – the cost is completely predictable and controllable, even when you are offering more choice. With this method, if all of your employees opt up to a high-level plan, your costs are still budgeted and capped even before the employee decisions are made at open enrollment.

Throughout this series you will find 5 methods to improve your benefits package – but each company is different and may have unique needs. Please feel free to reach out directly for a complimentary benefits evaluation to review specific ways your company can improve your benefits package and save money in the process:

Ingrid Greger

Benefit Experts Insurance Agency

Ingrid@benefitexperts.com

650.251.4228