The Dangers of A Bronze Health Plan

As an employer offering benefits for the first time or making changes to your benefits programs, you have two big decisions to make when it comes to quality of your program:

- How much do I contribute as the employer toward the employee and dependent premiums (what percentage do I pay for vs. what my employees pay for)?

- What level plan do I offer?

Employers with limited budgets can keep their costs in check one of two ways:

- Offer a lower plan tier (worse, therefore cheaper, coverage)

- Pay for a lower percentage of the premium

I am going to highly recommend that if you find yourself making a decision like this, you offer a better plan and pay a lower percentage of the premium. At first, this may seem detrimental to your employees, but it is actually better for them in the long run.

ACA plans come in 4 tiers: Bronze, Silver, Gold, and Platinum. Depending on industry and budget, we will recommend offering either a Gold or Platinum plan. Occasionally, for blue-collar businesses, a Silver plan is OK as it is the industry norm. But we never suggest Bronze plans.

In most cases, Bronze plans offer coverage that is essentially only useful in a catastrophic situation. With deductibles usually at $6,000 and up annually, you would have to have a major medical emergency or chronic illness to get past that deductible in a year and start using the actual benefits on the plan. So employees on a Bronze plan end up paying thousands out of pocket per year for normal procedures.

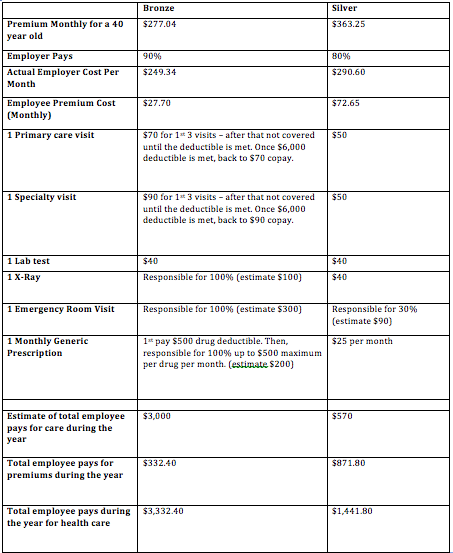

But often employees do not understand this and do not make informed decisions when signing up for benefits. They pick the cheapest option, do not read or do not understand the benefit summary, and then a few months down the line they are incredible upset that they have terrible coverage. You can avoid this by offering them a slightly better plan, even if you pay less percentage-wise towards it, because over the course of a year they will save money by paying more for their premium, if they use any medical coverage during the year. It can be argued that for those who do not go to the doctor, bronze is better, but we feel it is too great of a risk when one accident or illness can put them into debt. Here’s a quick overview of an employee’s hypothetical costs between a bronze plan and silver plan, using Kaiser as an example:

You can see that though the employer’s cost is pretty close dollar-wise on either level plan, an employee using moderate service levels during the year is going to save substantially by enrolling in a higher-level plan. By only offering a higher-level plan, you are saving your employees from making the decision to pick Bronze that they likely will later regret.